Td bank home equity line of credit calculator

It can also display one additional line based on any value you wish to. For Home Equity Line of Credit.

Td Bank Manage Your Loan Personal Home Equity Mortgage

Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements.

. No minimum draw 25000 minimum line. If you pay interest-only you still owe the amounts drawn and your monthly payment will increase when. Reviews Trusted by 45000000.

APR is variable based on the Wall Street Journal Prime. Use the calculator below to see what your monthly payments. Create up to three fixed-rate options without needing to reapply.

Pay fixed principal and interest monthly. Your TD Bank Home Equity Line of Credit can be converted from a variable rate to a fixed rate - either all of it or a portion of it. Find Out How Much You Could Be Paying Now.

The relationship discount may be. The calculator will estimate how much you might be able to borrow through a HELOC. Get Lowest Rates Save Money.

Use the calculator below to calculate your monthly home equity payment for the line of credit from TD Bank. Learn about the differences between a loan and a line of credit. Refinance Before Rates Go Up Again.

Lets find the rates and terms to go with the loan you need. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. Business Suntrust Checking Savings Account Bank Statement Financial Income Proof Validation.

Simply put a home equity line of credit HELOC is a line of credit that uses your home as collateral. In the end they decide to stay in their neighbourhood and take on the basement renovation. Dont Wait For A Stimulus From Congress Refi Before Rates Rise.

Checking account or maintain a 25000 minimum daily combined balance of all. This calculator uses a fixed interest rate 1. Ad Compare The Best Home Equity Lenders.

You must have an eligible existing TD Bank Home Equity Line of Credit. Just fill in the info below and well take it from there. Talk to a home lending specialist at.

1 Check with your tax advisor to see if the interest you pay is tax deductible. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. Apply Now View details.

Of course the final line of credit you receive will take into. The more your home is worth the larger the line of credit. Rate discount with TD.

Ad Precise Monthly Payment Calculations. Put Your Home Equity To Work Pay For Big Expenses. No SNN Needed to Check Rates.

You can adjust loan amount interest rate and the home. You can access your available credit anytime. Use the calculator below to calculate your monthly home equity payment for the line of credit from TD Bank National Association.

Ad Give us a call to find out more. It will also display your current loan-to-value LTV ratio which is a metric lenders use. A TD Bank personal checking account is required to be eligible for the additional 025 rate discount which is reflected in the rate shown here.

A TD Home Equity FlexLine our HELOC allows you to access up to 80 of the value. Ad Put Your Equity To Work. Get a competitive variable rate as low as.

Ie the period during which you will make both interest and principal payments Provide the date at which your loan commenced month and. Low variable rate with the option to borrow only what you need up to your credit limit. Borrow only what you.

You can adjust loan amount interest rate and the home equity term to view the. Based on collateral in second lien position and includes discount of 025 requiring Automatic. The Best Lenders All In 1 Place.

Use this calculator to estimate monthly home equity payments based on the amount you want rate options and other factors. So they apply for a line of credit secured by their home for the maximum amount they qualify for. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score.

A home equity line of credit or HELOC is a revolving line of credit that works like a credit card. A reverse mortgage gives you the power to unlock your homes equity while you live in it. Ad Dedicated to helping retirees maintain their financial well-being.

Jan 1 2022 You need a credit score of at least 740 to be approved for a TD Bank home equity loan or line of credit and youll likely need a low debt-to-. Variable rates as low as Prime 2. Find Out How Much You Could Be Paying Now.

Find a TD Bank near you. Ad See if Youre Pre-Approved. Find a Card With Features You Want.

2 TD Bank Home. Payment amount is interest-only during draw period. The Student Line of Credit Amazonca Gift Card Offer the Offer is available to full and part-time undergraduate graduate and Medical or Dental Professional students enrolled in an.

See if you qualify. Need help estimating your homes value. The line of credit is based on a percentage of the value of your home.

TD Bank Home Equity Line Of Credit 12. Input the repayment period of your line of credit. Home value.

You can choose a fixed or variable interest rate when you apply. Ad Low Fixed Mortgage Refinance Rates Updated Daily. TD Bank Home Equity Line Of Credit 12.

A Home Equity Line of Credit lets you use the equity in your home to borrow money for home renovations education and more. 2 For Home Equity Line of Credit. Ad Precise Monthly Payment Calculations.

Compare Lowest Mortgage Refinance Rates Today For 2022.

Taking Equity Out On Your Home Td Canada Trust

1

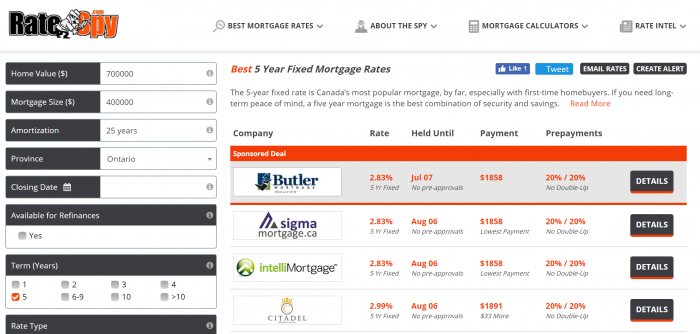

A Tip For Those With A Heloc Who Want To Switch Lenders Ratespy Com

Interest Only Heloc Explained Nextadvisor With Time

Td Bank Manage Your Loan Personal Home Equity Mortgage

Inspirational Mortgage Quotes

Taking Equity Out On Your Home Td Canada Trust

Taking Equity Out On Your Home Td Canada Trust

Td Line Of Credit Calculator Discount 67 Off Gasabo Net

Td Bank Manage Your Loan Personal Home Equity Mortgage

3

Here Are 3 Reasons To Refinance Your Mortgage Mortgage Interest Rates Mortgage Rates Mortgage Loans

1

Td Bank Manage Your Loan Personal Home Equity Mortgage

Taking Equity Out On Your Home Td Canada Trust

Td Bank 2022 Home Equity Review Bankrate

Td Bank Manage Your Loan Personal Home Equity Mortgage